Why VA Home Loans Are the very best Home Loan Choice for Professionals

Why VA Home Loans Are the very best Home Loan Choice for Professionals

Blog Article

The Important Overview to Home Loans: Opening the Advantages of Flexible Financing Options for Your Desire Home

Browsing the complexities of home loans can often feel challenging, yet understanding flexible financing options is important for potential homeowners. VA Home Loans. With a selection of car loan types offered, consisting of government-backed alternatives and adjustable-rate mortgages, debtors can customize their financing to align with their specific economic circumstances.

Comprehending Home Loans

Comprehending mortgage is necessary for prospective homeowners, as they represent a substantial economic commitment that can impact one's economic health and wellness for years to find. A home lending, or home loan, is a sort of financial debt that enables individuals to borrow money to purchase a building, with the residential or commercial property itself functioning as security. The loan provider provides the funds, and the consumer accepts pay off the funding quantity, plus rate of interest, over a specified duration.

Key parts of mortgage include the primary quantity, rates of interest, finance term, and month-to-month repayments. The principal is the original loan amount, while the rate of interest identifies the price of loaning. Car loan terms commonly range from 15 to thirty years, affecting both regular monthly settlements and overall rate of interest paid.

Types of Flexible Funding

Flexible funding alternatives play a vital duty in suiting the varied needs of homebuyers, enabling them to tailor their home mortgage options to fit their financial circumstances. One of one of the most prevalent kinds of flexible funding is the variable-rate mortgage (ARM), which supplies a preliminary fixed-rate duration followed by variable prices that fluctuate based on market problems. This can offer reduced initial settlements, appealing to those who anticipate income growth or strategy to relocate prior to prices adjust.

One more alternative is the interest-only mortgage, enabling borrowers to pay only the passion for a specified period. This can lead to reduced monthly payments originally, making homeownership more easily accessible, although it might result in larger settlements later on.

Additionally, there are also hybrid financings, which combine functions of dealt with and variable-rate mortgages, offering stability for an established term complied with by changes.

Lastly, government-backed car loans, such as FHA and VA finances, supply flexible terms and lower down payment requirements, accommodating first-time purchasers and professionals. Each of these choices provides unique benefits, allowing homebuyers to select a financing service that aligns with their long-term individual scenarios and monetary goals.

Advantages of Adjustable-Rate Mortgages

Just how can variable-rate mortgages (ARMs) benefit buyers looking for cost effective financing options? ARMs use the potential for lower preliminary rate of interest prices contrasted to fixed-rate mortgages, making them an attractive option for purchasers aiming to reduce their monthly payments in the early years of homeownership. This preliminary period of lower rates can dramatically enhance affordability, allowing homebuyers to invest the savings in other priorities, such as home renovations or savings.

Furthermore, ARMs usually feature a cap framework that restricts just how a lot the rate of interest can increase throughout change durations, giving a degree of predictability and security against extreme fluctuations on the market. This feature can be particularly advantageous in a rising rate of interest environment.

Furthermore, ARMs are ideal for customers that prepare to re-finance or offer prior to the lending adjusts, allowing them to maximize the lower rates without direct exposure to potential rate rises. Therefore, ARMs can serve as a strategic economic device for those who fit with a degree of threat and are seeking to maximize their acquiring power in the present housing market. On the whole, ARMs can be Learn More Here a compelling choice for wise buyers seeking flexible funding solutions.

Government-Backed Finance Alternatives

FHA financings, insured by the Federal Real Estate Administration, are perfect for novice property buyers and those with reduced credit report. They usually need a reduced deposit, making them a prominent option for those that might battle to conserve a considerable quantity for a standard financing.

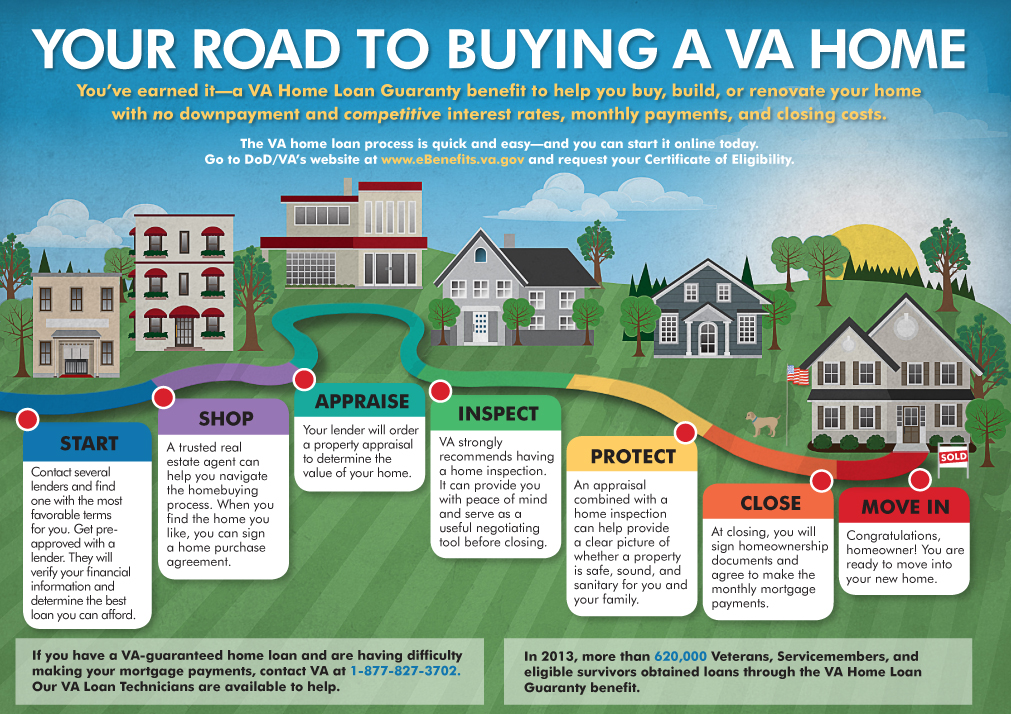

VA finances, readily available to professionals and active-duty army employees, use desirable terms, consisting of no deposit and no exclusive home loan insurance (PMI) This makes them an attractive alternative for qualified debtors wanting to buy a home without the problem of extra costs.

Tips for Picking the Right Finance

When evaluating finance options, debtors often benefit from extensively assessing their monetary scenario and long-term goals. Begin by determining your budget, that includes not just the home acquisition price however likewise added costs such as real estate tax, insurance, and maintenance (VA Home Loans). This detailed understanding will certainly guide you in selecting a funding that fits your economic landscape

Following, take into consideration the kinds of fundings readily available. Fixed-rate home mortgages supply stability in monthly payments, while adjustable-rate home loans may offer reduced preliminary prices however can change gradually. Analyze your threat resistance and just how lengthy you intend to remain in the home, as these variables will influence your car loan option.

Additionally, scrutinize rate of interest and costs associated with each financing. A lower rate of interest rate can substantially reduce the total price with time, yet be conscious of closing costs and other costs that may offset these cost savings.

Conclusion

In conclusion, browsing the landscape of home mortgage discloses countless versatile financing options that deal with varied consumer requirements. Understanding the intricacies of numerous funding types, consisting of variable-rate mortgages and government-backed lendings, allows informed decision-making. The his response benefits provided by these funding techniques, such as reduced preliminary repayments and tailored advantages, ultimately improve homeownership ease of access. A thorough examination of available alternatives guarantees that potential homeowners can safeguard the most appropriate funding service for their one-of-a-kind financial scenarios.

Browsing the intricacies of home car loans can commonly really feel complicated, yet recognizing flexible financing options is necessary for possible property owners. A home loan, or mortgage, is a kind of financial obligation that enables people to obtain cash to acquire a building, with the residential property itself offering as security.Trick elements of home financings consist of the major find more information quantity, passion price, finance term, and month-to-month settlements.In verdict, browsing the landscape of home finances discloses many versatile financing options that provide to diverse customer requirements. Understanding the intricacies of various lending kinds, consisting of adjustable-rate home mortgages and government-backed finances, allows informed decision-making.

Report this page